Widening demand/supply gap in senior housing in Germany

The gap between growing demand and shrinking supply in the German senior housing sector is getting ever wider, delegates heard at the SHHA webinar on ‘Senior living & care – is Germany ready for consolidation and international capital?’, which was organised in collaboration with Real Asset Media.

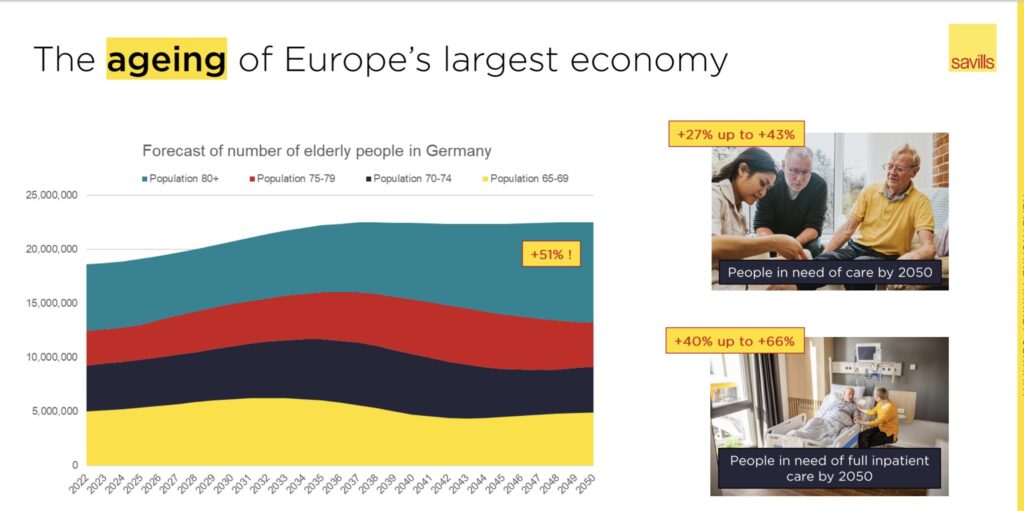

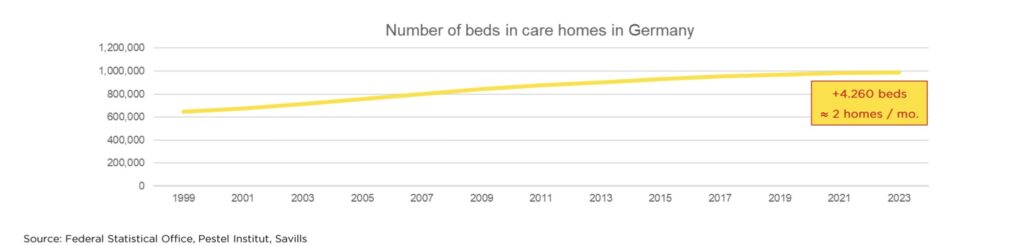

“To meet the additional demand Germany needs to build 41 care homes a month every month between now and 2040, but it is building less than two a month”, said Matti Schenk, Associate Director Research, Savills Germany. “There is insufficient development activity, yet the need will grow at double digit rates for all segments, from care homes to assisted living.”

The reasons are clear when looking at the demographics: the German population is ageing fast and the number of people over the age of 80 will increase by 51% by 2050 to over 9 million.

At present 86% of older people are cared for at home, but the vast majority of them (78%) do not live in senior-friendly housing but have to navigate stairs and internal barriers.

“Senior living must be built at scale and fast”, said Schenk. “At the same time, homes must be modified and adapted, and the existing stock of senior housing must be modernised, as most were built before 2000 and need to be updated.”

The upshot of these statistics is clear, he said: “A massive amount of capital is urgently needed for new construction and for the modernization of existing assets, and private capital is essential to meet this challenge.”

On the negative side, in recent years problems like high interest rates and the insolvency of some operators have led to a sharp decline in transaction volumes in the sector. The current annual figure is €1.2 billion, a far cry from the €4 billion before the crisis.

On the positive side, the market is very liquid and the opportunities it offers are luring foreign investors back.

“Foreign capital had dominated the sector for years, mainly specialised REITs from Benelux and the Nordics, but had been shrinking recently”, said Schenk. “Now investors are coming from different geographies, including Spain and Asia-Pacific. Germany has more of a global appeal, because of its size and of the demographics story.”

There are two main problems investors have to deal with: the first is the fragmentation of the market on the ownership as well as operator side. The top ten operators in Germany have a market share of just 14.3%.

The other issue is the maze of different regulations, as there are 16 Care Home Acts in the 16 federal States, or Bundesländer.

“If you have a large portfolio you need to deal with many different operators, which makes due diligence complex, as well as having to get to grips with different regulations even for the same type of building depending on the location”, said Schenk. “Having a strong local partner is essential for investors entering the market.”

Investors realise the huge potential of the German market and interest is growing, but some can be deterred by the obstacles in their path and the questions about the sustainability of the healthcare system due to rising costs and staff shortages.

“A comprehensive reform of the system is necessary”, he said. “As it is clear that more private capital is needed, both domestic and foreign, the authorities should make it easier for it to be deployed”.