C&W: more stores are set to become micro delivery hubs

Retail and logistics are two sides of the same coin, the latest Cushman & Wakefield research shows, and they work best when they join forces, each supporting and strengthening the other.

“Logistics has been pushed up the value chain,” Sally Bruer, partner, logistics and industrial insight and strategy EMEA, Cushman & Wakefield, told Real Asset Insight. “It’s no longer an operational necessity, it has become a strategic necessity. Retailers and logistics operators must deliver the product to the consumer in the most efficient and margin-enhancing way.”

We have seen five years’ worth of growth in online shopping in just one year because of the pandemic and the forecast is for this trend to continue because consumers’ habits have changed during the lockdowns.

Now, post-pandemic, the environment is more of a hybrid. The shopping journey is a combination of online and in-store.

“What is challenging is that consumers move seamlessly between the physical and the digital,” she said. “But retailers have the opportunity to establish brand awareness and loyalty and deepen the consumers’ relationship with their brand.”

The system used to be simple, as products move to the warehouse then to the shop where shoppers bought them. Now the shop is just one of many ways of getting the product, along with click & collect, delivery at home, at work or in a locker.

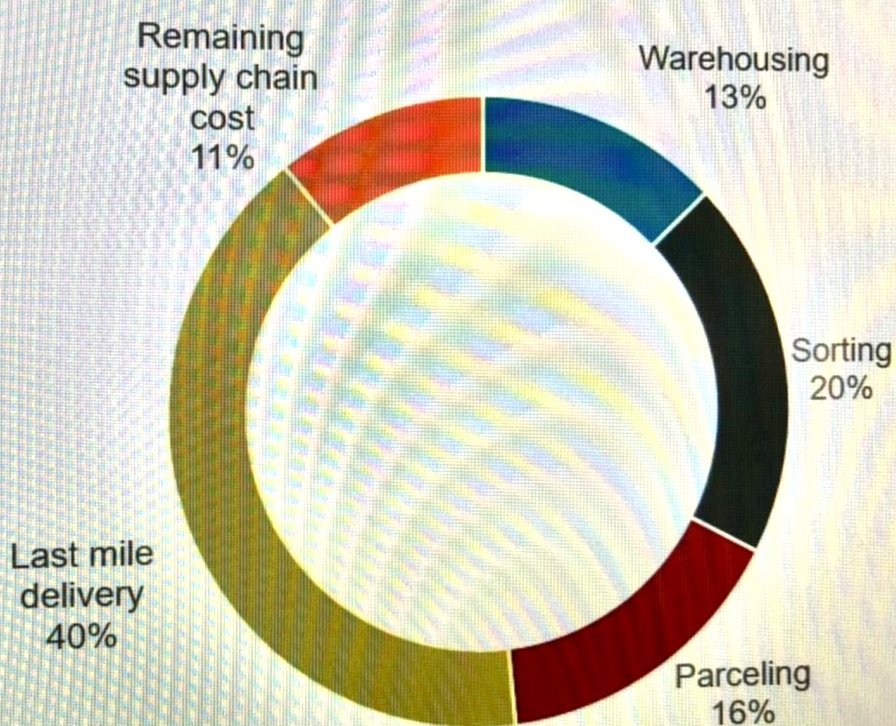

“All this complexity, and the challenging issue of returns, adds costs for the retailer,” said Bruer. “The last mile is by far the largest component of supply chain costs, accounting for 40% of the total.”

For this reason retailers have started to use their physical stores as micro-delivery hubs, because they are close to the consumers.

Major names reconfiguring stores to deliver goods to online customers

“It means that retailers can make incremental cost savings for each delivery,” she said. “Brands like Zara, Hobbes, Kingfisher, Castorama and B&Q have been reconfiguring their stores to get products directly to online consumers.”

The problem with shopping centres and high street shops is that the small size of stores makes it difficult to keep the inventory without spoiling the instore experience, she said.

Online shopping in Europe has grown in general, but penetration rates differ by country and by product segment as well. Electricals & Electronics have shot up to over 40% of total sales, while fashion and clothing are just shy of 30% but food is still below 5%.

Online food sales are still very low but “as the largest proportion of spending is food, it represents a huge potential for online retail,” Bruer said. “Grocery is the biggest opportunity, because supermarkets are close to consumers, they have larger floor spaces which is a crucial factor and they have car parks too.”

Big names like Tesco have already started carving off some of the space in their supermarkets and hypermarkets just for online fulfilment, keeping the two separate so that in-store customers can have the usual experience.