Garbe Pyramid: logistics sector resilient, but rental growth slow

Europe’s logistics sector is showing resilience, but the rental growth dynamic is expected to slow over the next five years, delegates heard at the Garbe Pyramid H1 2026 presentation, organised by Garbe and Real Asset Media, which took place online on Thursday this week.

“The outlook for rents and returns is stability rather than outperformance”, said Tobias Kassner, Head of Research & ESG at GARBE Industrial. “Take-up is higher but vacancies have also increased from historic lows, while transaction volumes are lower, back to pre-pandemic averages.”

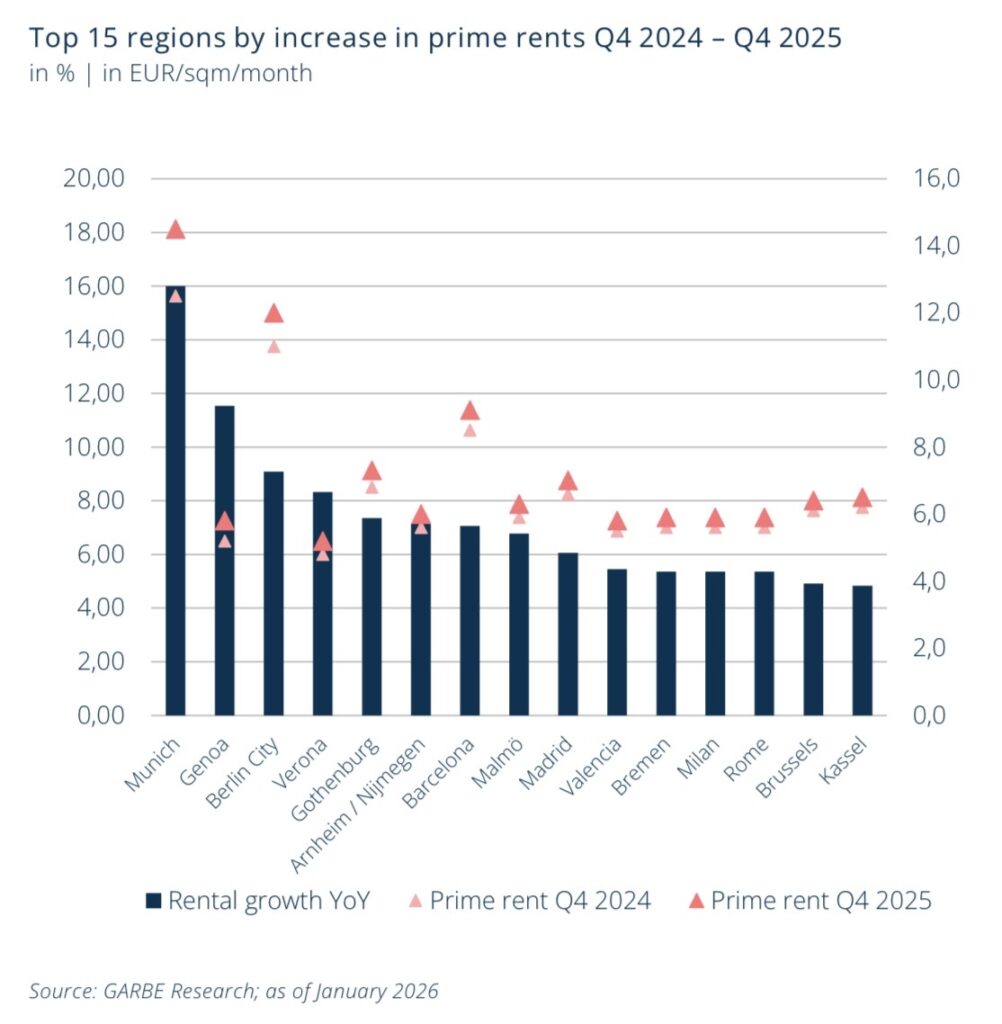

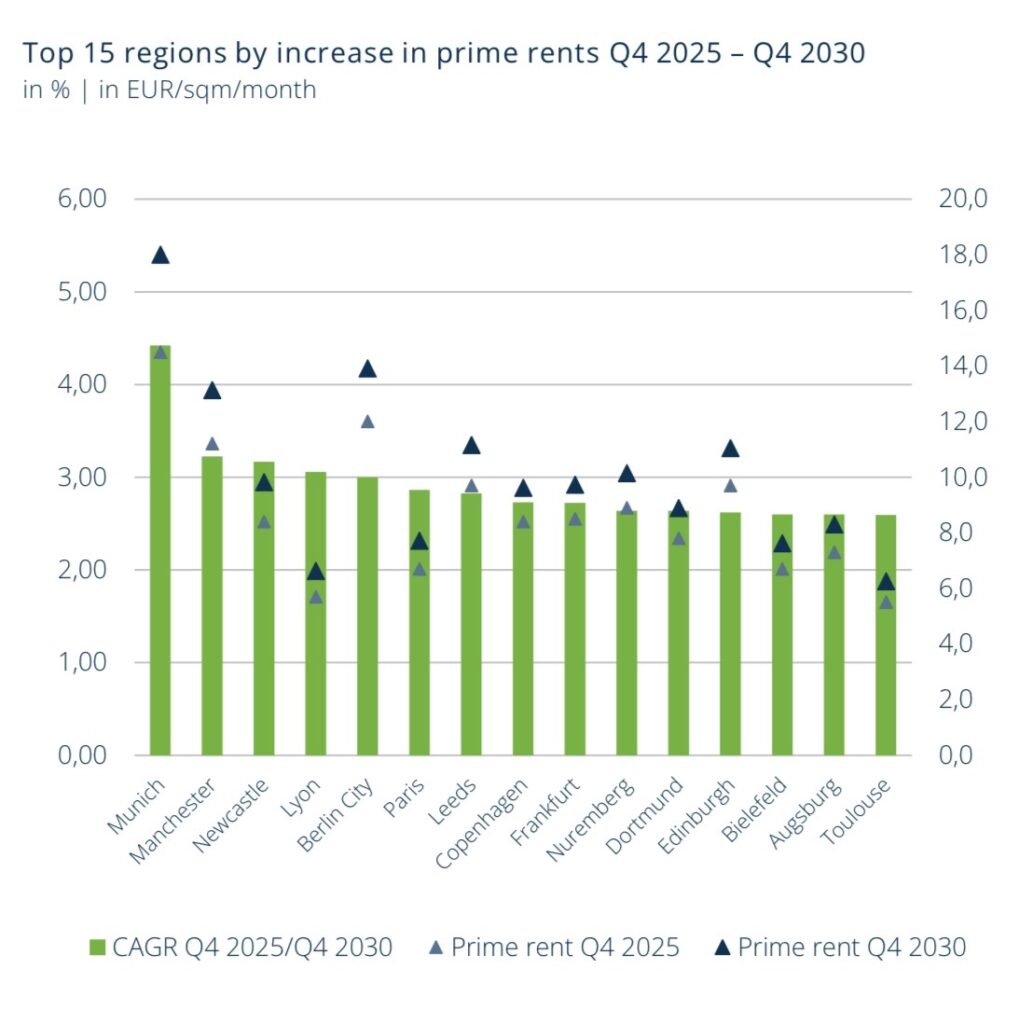

The annual rent growth rate has been 5.7% on average during the past five years, but the forecast for the next five years predicts a 1.9% increase. Yields will also see a stabilisation phase: since Q2 2022 the average prime yield across the 122 regions rose from 4.6% to 5.7% percent, while the most recent quarters show a toward yield compression. In the years ahead, the moderate decline in yields is predicted to continue across the 88 markets, down to a level of 5.2% by 2030.

Many European logistics markets continue to show potential for growth. In fact, prime rents are expected to increase by more than 10% in 45 of the analysed regions between now and 2030. The strongest impulses are coming from established core markets in countries like Germany, the United Kingdom, France and the Netherlands. One market that clearly stands out is Munich, that benefits from strong local demand, a structurally short supply and a strong local economy, meaning that the dynamic rent growth of recent years will continue.

Other established markets will take the lead. The most promising performance prospects are offered primarily by liquid core markets where moderate rent growth coincides with stable yield rates. Looking ahead to 2030, Munich will still be on top, with Manchester and Newcastle in second and third place.

These are the findings in the 11th edition of Garbe’ Pyramid Map, which covers the logistics markets in 122 regions in 25 European countries and provides expert forecast developed together with Oxford Economics that covers 88 out of 122 European logistics regions.

“The turbolent geopolitical context and dynamic market environment make reliable market updates and forecasts all the more relevant”, said Kassner. The economic and geopolitical environment has become much more volatile over the past years, and there are no signs the situation will stabilise. At the same time, no major economic upturn is to be expected in the near term, therefore it is likely that the market dynamics in Europe’s logistics real estate markets will largely remain muted in the next few years.

On the other hand, Europe’s logistics sector is progressively decoupling from geopolitical events, whose immediate impact on these markets is diminishing accordingly. Markets respond with a certain delay, while market development differs considerably from one region to the next.

“Market players are increasingly coming to terms with the new reality, are abandoning their wait-and-see attitude and have begun to resume trading,” said Kassner. “Given the market corrections of the past few years, we believe the time for sweeping adjustments has come and gone. Stability is here to stay and growth is happening – albeit selectively and strongly dependent on location.”

European supply chains and production are becoming increasingly self-sufficient, which will lead to more demand for I&L facilities. “Changed trade flows, realigned supply chains and the focus on strategic resilience and defence will define the logistics real estate markets for a long time to come and generate positive momentum”, said Kassner.