Positive end to 2025 for Poland after a ‘disappointing’ year

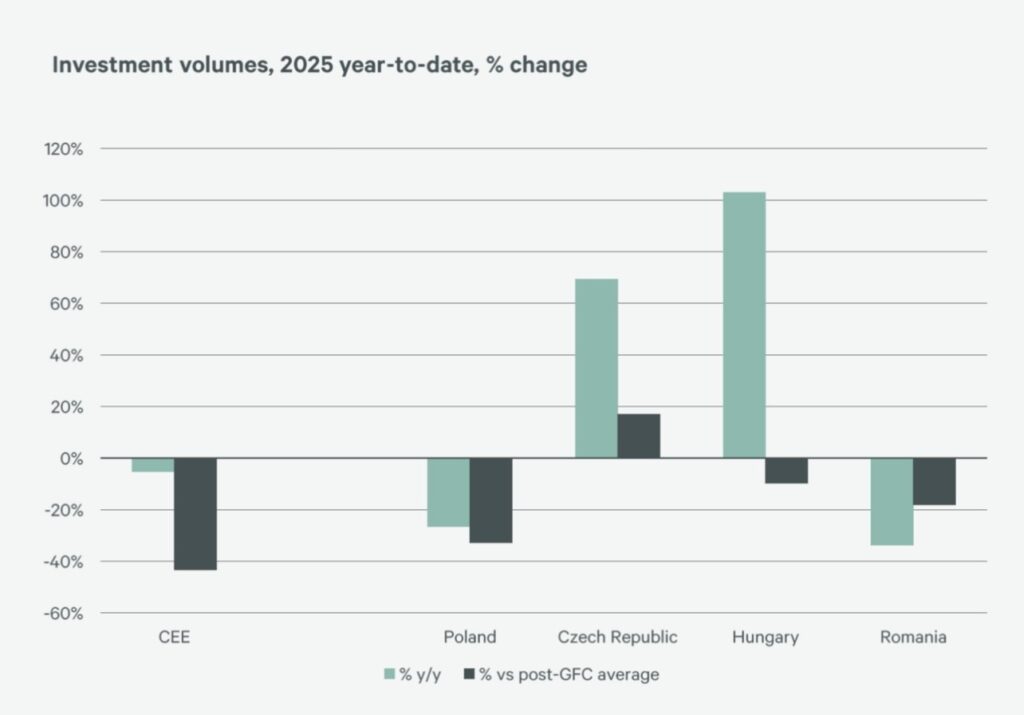

Poland has seen a dip in investments earlier this year but the market is picking up now, experts agreed at Real Asset Media’s Trends 2025: CEE Investment briefing, which took place on Thursday, hosted by CMS at their offices in the City of London.

“We had high expectations at the beginning of the year and were ambitious on investment activity”, said Justyna Kedzierska-Klukowska, Head of Warsaw Office, Berlin Hyp. “There is an element of disappointment, but in the last few months we have seen an increase in investment volumes.”

There have been over 100 transactions in the first nine months of the year, she said, although most have been opportunistic.

“The positive aspect is that there are many regional investors now and Poland is getting Czech as well as Lithuanian and Nordics capital”, said Michał Mieciński, Partner, Real Estate and Construction Department, CMS. “This means we are no longer dependent on Western European money.”

Despite the country’s good performance and strong economic fundamentals, foreign investors from Germany or France have been cautious in a context of geopolitical uncertainty.

“Liquidity has been the weak spot, but we’re seeing some improvements now, so looking ahead I am positive about prospects for the market”, said Ruben Bos, Head of Real Estate Investment Strategy, Europe, DWS.

Investors can have different points of view, said Anna Wiśniewska, Counsel, Real Estate and Construction Department, CMS: “Some of our clients avoid Poland because of lack of liquidity, others avoid the Czech Republic because there is too much competition from domestic players.”

Foreign capital still dominates in Poland, accounting for some 85% of transactions, but smaller deals are being done by Polish capital, focusing on resilient sectors.

“Domestic investors are showing more interest in real estate, but they cannot compete with the big players”, said Kedzierska-Klukowska. “They cannot target €100 million-plus assets, so they settle for smaller tickets.”

The relative lack of domestic involvement in the Polish market is also due to the lack of a REIT regime, which has been discussed for years but repeatedly delayed by successive governments.

“The Czech Republic has developed a great and successful REITs system, but in Poland the idea has been dropped because the government is afraid of a crisis or a resi bubble”, said Mieciński. “We still hope REITs will be approved at some point in the future.”

Another reason for Western investors’ partial retreat from CEE markets is due to the fact that there are deals to be done closer to home.

“There has been such extensive repricing in European markets that investors find good value opportunities in many places, and it is easier to get the investment committee to approve a German deal”, said Bos.