Garbe: supply chain resilience makes CEE markets attractive

Supply chain resilience and economic growth are the key to Central and Eastern Europe’s attractiveness, delegates heard at the ‘Garbe Pyramid H1 2025: European Logistics Real Estate Markets between awakening and stagnation’ presentation, organised by Garbe and Real Asset Media, which took place online this week.

“The CEE region is best placed to capture the demand potential of the supply chain de-risking trend”, said Martin Polak, Managing Director Central & Eastern Europe, Garbe. “Big improvements in infrastructure have created logistics corridors which are driving CEE connectivity and facilitating supply chains. All markets are connected.”

Motorways have been expanded and transport connections improved throughout the region, while the East-West transport corridor makes delivery by road from Asia, across the CEE region, much faster than the ocean route.

The region’s economies are outperforming, especially compared to the sluggish large economies of Western Europe, and the outlook is positive. Consumer confidence and domestic consumption are high, which means CEE countries are strong markets in their own right for logistics operators as well as being a good springboard for distribution in other countries.

“CEE can also offer competitive labour costs and skilled force availability, as well as lower rental prices, which is why we see many Eastern companies setting up distribution hubs in the region”, he said.

One example is Nobo Automotive Systems, a Chinese company that has leased a 30,000 sq m warehouse in Budweis, in the Czech Republic, just three hours’ drive from Munich, to set up a plant to assemble car seat sets (for BMW as well), and to produce critical components.

“Having a presence in the region is more efficient for Nobo and they, like other Asian companies, are bringing their know-how and technological skills to Europe”, said Polak. “This is a value-add manufacturing deal that brings Chinese investment, state-of-the-art facility development, substantial job creation and sustainable manufacturing to the Czech Republic.”

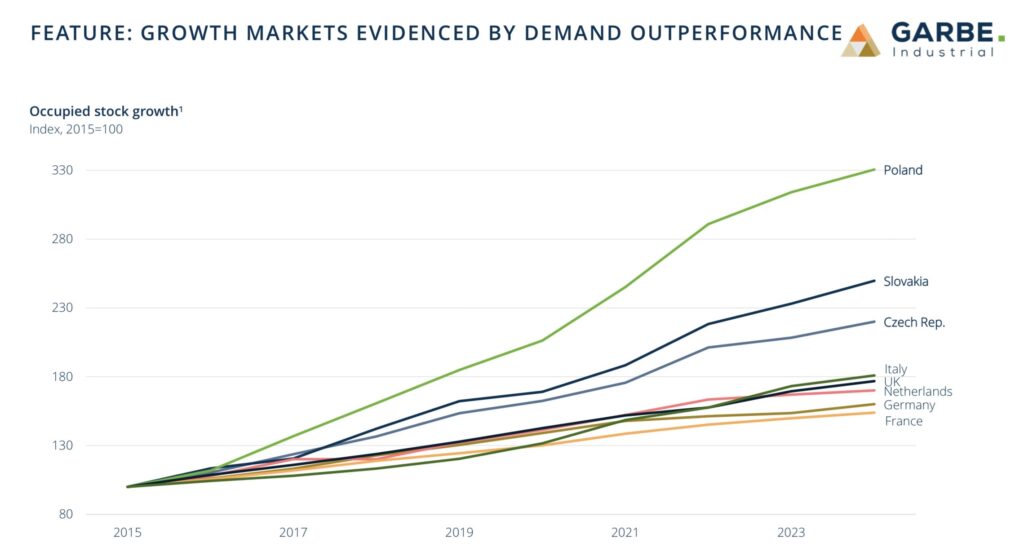

Among CEE countries Poland is ahead, followed by Slovakia and the Czech Republic, according to Savills research. Poland leads because of its size and availability of land and assets and is regarded as a stable and transparent market by investors.

On the negative side, Poland’s vacancy rate is 8.5%, which is high and will dampen rent growth, said Polak, but there is a positive aspect: “It will be easier for companies to expand and find space, and Poland is attracting both new and established companies.”

Poland’s strong consumer demand is an added attraction and it is not just foreign companies that are taking advantage of it. LPP, a Polish clothing company, has opened 572 stores in 2024, most of them under the Sinsay fashion brand, and recorded 50% revenue growth. The group is now targeting 1,500 new store openings between this year and 2027. “LPP’s current and future expansion requires a substantial logistics and warehousing network, so demand will be high”, said Polak.

“No region in CEE is seen as underperforming, which is remarkable”, he said. “However, there are some that are outperforming, like Bratislava, Budapest, Ljubljana, Gdansk, Katowice and Warsaw, have lower vacancy rates and can demand higher rents.”

Some locations in the Czech Republic, like Prague and Brno, are attracting investors, but the availability of land and space is very limited and it is difficult to build.

“Katowice and Warsaw represent the potential of Poland, as they combine elements of emerging markets, such as strong demand, with features of well-established markets, such as liquidity”, said Polak.