Logistics Census: ESG and AI adoption the game-changers

ESG regulation and AI adoption are seen by occupiers as the two game-changing trends in logistics, according to the 2025 European Logistics Real Estate Census, jointly produced by Savills, Brookfield Properties and Analytiqa, which has just been published and was presented in London this week at an event organised with Real Asset Media.

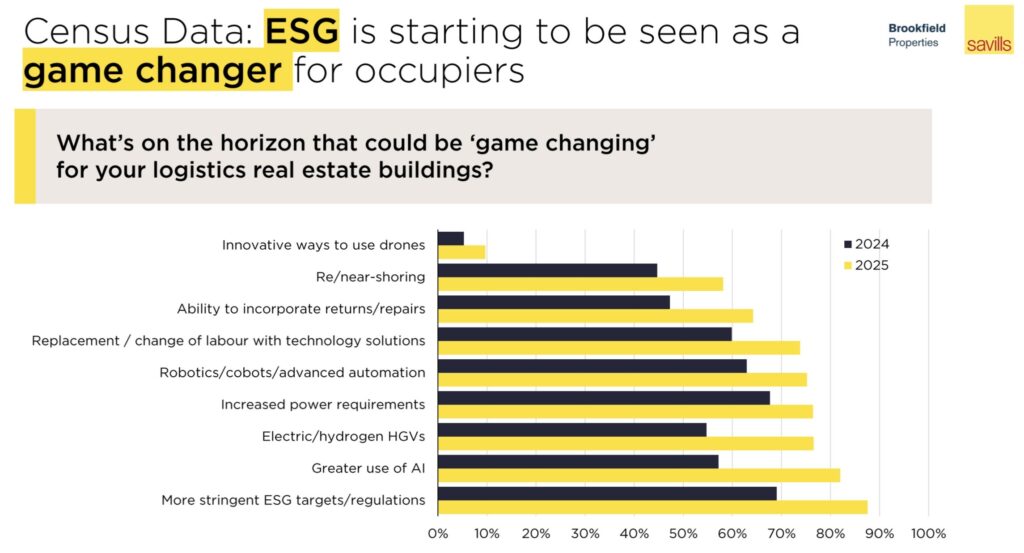

For the second year in a row more stringent ESG requirements are ranked at the top, identified by more than 8 in 10 occupiers as crucial, closely followed by the use of artificial intelligence. AI adoption has surged by 25% year-on-year.

“This year’s Census underlines how structural shifts are shaping the next chapter of logistics real estate”, said George Coleman, UK & EMEA Logistics, Savills. “ESG and AI are no longer emerging trends but central to occupy strategies, while investors and developers are positioning to deliver the space needed for this transformation. The sector continues to adapt with resilience and is building solid foundations for long term sustained growth.”

Occupiers are actively seeking more efficient and resilient facilities. ESG regulation is now viewed as the single most significant structural shift, with 88% of occupiers rating it a game-changing trend. At the same time, momentum behind AI is accelerating rapidly. A striking 82% of occupiers see AI as transformational, representing a 25% jump from last year. Over a third have already invested in predictive optimization and analytics technologies, and nearly half plan further investment within the next two years. In contrast, automation has slipped in priority – likely due to power constraints and capex limitations.

“Occupiers remain cautious, recalibrating in response to macro and operational pressures, yet they are actively shaping strategies around ESG and AI to futureproof their portfolios”, said Ben Segelman, European Head of Logistics & Data Centre Real Estate, Brookfield Asset Management. “The next 12 to 18 months will be pivotal in aligning demand with the right kind of space.”

It is clear from the Census that ESG, AI, and infrastructure will be central to shaping the next phase of European logistics real estate. While volatility remains a defining feature of the landscape, the market continues to demonstrate structural resilience.

Although investment volumes fell 22% from H2 2024, they remain 11% above long-term averages, which points to sustained investor conviction. Investor appetite for logistics assets remains well above trend, accounting for 22% of total capital deployed into European real estate, considerably higher than the 13% of the total market back in 2018.

Another potential positive for the sector is a shrinking development pipeline, which may compress vacancy rates and drive future demand. “As the pipeline continues to decrease, in the next three years we are likely to see vacancies fall”, said Kevin Mofid, head of EMEA logistics research, Savills.

Savills European Pipeline Index indicates that the development pipeline across Europe has fallen by 28% since its peak in Q1 2023, which, in combination with rising requirements amongst occupiers, should put downward pressure on vacancy rates across Europe over the medium to long term. Looking to the UK market, which typically precedes European trends by about three-quarters, the speculative development pipeline has contracted substantially from its peak in Q4 2022, falling by 58% to current levels in Q2 2025.