Investment activity in logistics market set to increase: Garbe

Investment activity is expected to pick up in Europe’s logistics market and rents will start rising again, according to Garbe Pyramid 2025, the latest research on the sector presented by Garbe Industrial Real Estate and Real Asset Media in an online briefing this week.

“Looking ahead the situation becomes more favourable and investor sentiment is improving,” said Tobias Kassner, head of research and ESG, member of the executive board, Garbe Industrial Real Estate. “Many had been waiting for prices to decline, but now they are starting to deploy capital.”

The economic recovery, boosted by lower inflation and interest rates, will bolster investor sentiment and improve liquidity in the market.

“Consumer sentiment is also improving, so e-commerce is doing very well, which compensates for the slowdown in industrial activity in some markets,” said Kassner. “But there is still a lot of caution in the market, capital flows and new investors are not what they were and the pipeline has slowed down.”

Construction pipelines have been at low levels since December 2020 and Garbe expects a further deceleration due to financing conditions, weak demand, higher vacancy levels, and tightening regulations.

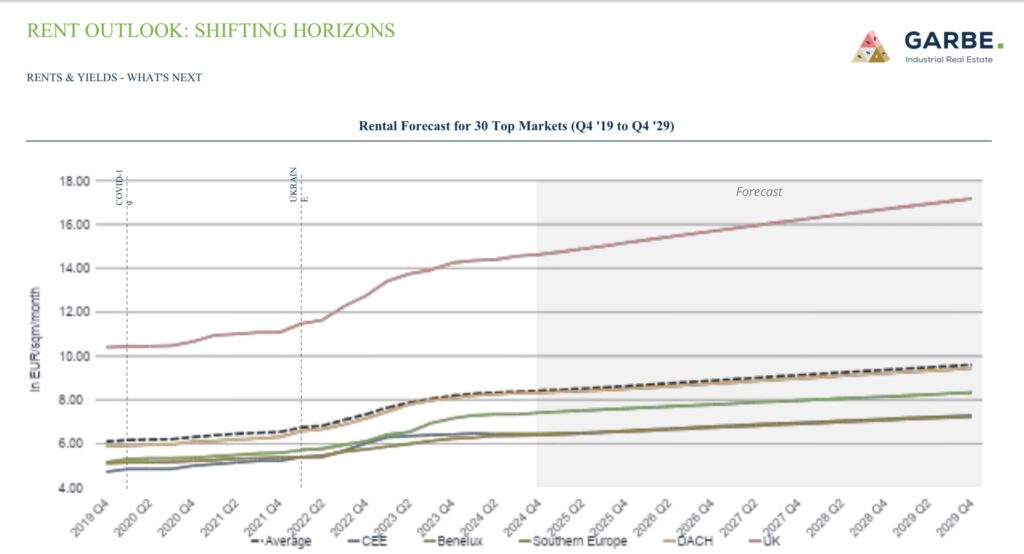

Garbe Pyramid 2025 presents a snapshot of the sector in the last six months and also includes an expert forecast for the 30 top markets between now and Q4 2029, based on analysis done by Oxford Economics.

“The forecast is that in the next five years there will be above-inflation rental increases in almost all markets,” said Kassner.

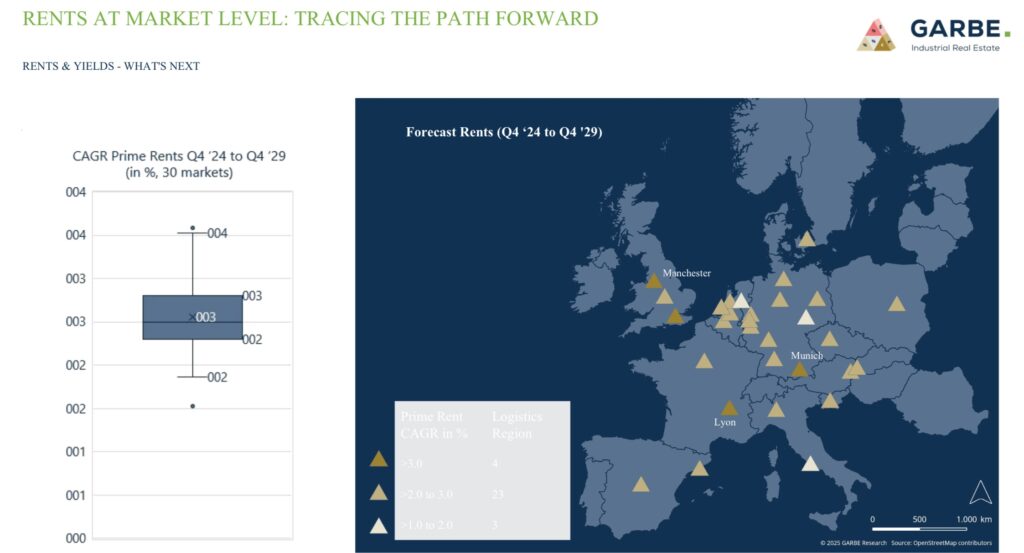

There will not be a sudden spike, but more moderate and gradual increases of 14% on average until Q4 2029, a compound annual growth rate of 2.5%. Four regions – London, Manchester, Lyon and Munich – will outperform, with rental rises of over 3%, while most markets will settle for increases between 2% and 3%.

There will be a focus on quality as tenants become more selective. “For many years in Europe everything was let, even old stock, because demand always outstripped supply,” said Kassner. “Now that’s all changed. This means there is a window of opportunity with a particular focus on prime locations, strong tenants, and ESG covenants.”

Yield compression is set to continue, with an average decline of 70 bps forecast over the next five years. Core markets and the CEE region are expected to lead the compression trend.

CEE markets are most promising, according to Garbe, because logistics assets will be in demand from companies that are reshoring and looking for places where land is cheaper, a skilled labour force is available and the transport infrastructure is good.

“Infrastructure, such as the road from Poland to Turkey, will play a bigger role,” said Kassner. “Southern Europe and CEE are the most interesting markets to invest in because there a lot less development there. Investors can still benefit from first mover advantage.”