CEE markets more attractive but ‘a new narrative’ needed

CEE markets offer opportunities across sectors but they “need a new narrative” to entice foreign investors back, delegates heard at Real Asset Media’s CEE Investment briefing, which took place this week, hosted by CMS at their offices in the City of London.

“CEE is still an attractive entry point into the European market and there are opportunies to be found across the board”, said David Inskip, EMEA Head of Research, CBRE Investment Management, in his keynote presentation. “Income growth rather than yield compression will drive future returns, and they will be sustainable returns.”

The CEE region has not been immune from the uncertainty caused by tariffs and geopolitical events, which has paused the improvements in liquidity and led to a fall in investment volumes.

However, the data on recent investment activity highlight the differences between CEE markets, with Poland and Romania down both year-on-year and compared to the post-financial crisis average and Hungary up YOY but down on the post-GFC average. The standout country is the Czech Republic, which is up on both metrics.

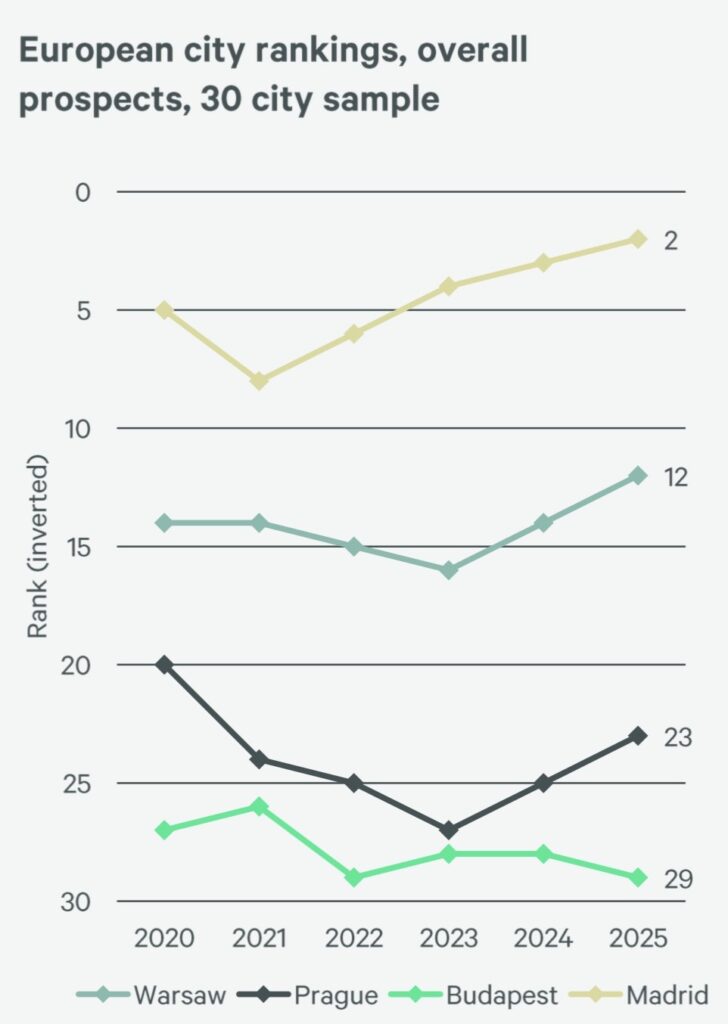

Among European cities, Budapest has lost ground while Warsaw and Prague are up, respectively at n12 and n23 in the rankings.

On the positive side, the CEE region has proved to be resilient and has seen more modest declines in valuations than Western Europe. There are also huge variations between sectors, with retail showing a marked rebound while logistics has fallen from recent heights but is picking up again and offices are on a downward trend.

In the past decade CEE has been a great beneficiary of the logistics boom, but “the path ahead is less clear”, he said, even though the sector still accounts for a larger share of total transactions in the region than anywhere else in Europe.

Residential is a growing sector driven by strong demand, said Inskip, but “the market has no depth yet, so there are no reliable data and no transparency. However, the market is moving towards maturity so we will get there, and then investors will be able to justify their hedging costs with outperformance.”

Investor sentiment towards CEE markets has improved, but investors are still more mindful of risks in CEE than elsewhere in Europe, particularly geopolitical concerns, he said, but “on the other hand, surveys show that people’s main worries are about the deterioration of public finances and the AI bubble, and on these two fronts CEE is in a better position.”

The advice to investors looking for opportunities is to focus on the particular rather than the general. “This cycle is not following a typical pattern, and the next cycle will be all about picking the right assets rather than the right sector”, said Inskip. “What CEE markets need is a new narrative that can attract more global investors.”