Take-up and deals to increase in H2 in Dutch logistics market

Both take-up and investment volumes are set to increase in H2 in the Dutch logistics market, delegates heard at the European Investment Outlook: Netherlands briefing, organised by Real Asset Media, which took place recently at the offices of CMS in Amsterdam.

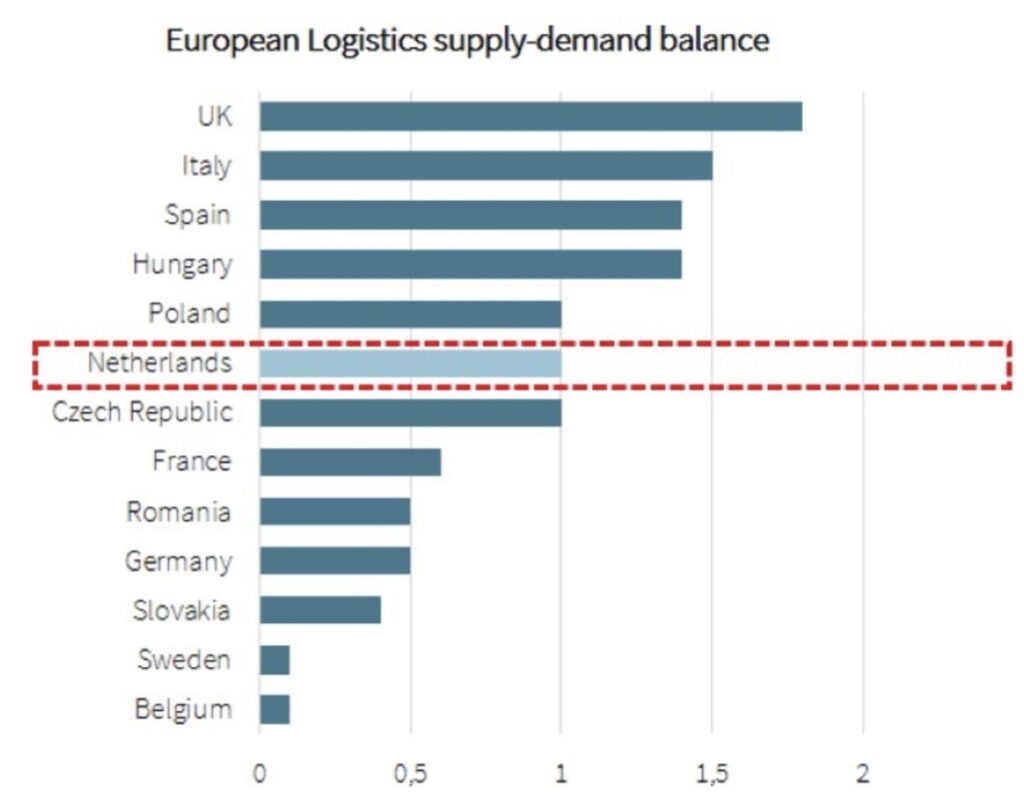

“The Dutch market had a slow start to 2025, but demand for logistics assets is growing again”, said Sven Bertens, Head of Research & Strategy, JLL Netherlands. “Rising new space requirements should back stronger lease activity in H2.”

Take-up in H1 has been 696,000 sq.m, lower than the last few years, as occupiers chose to be cautious in an uncertain economic and geopolitical environment. But lease activity has been 3% higher than the pre-pandemic average, a sign that logistics demand is still resilient.

“Rising space requirements in most markets are a clear signal that occupiers are coming to terms with uncertainty being the new normal, pointing to stronger lease activity later in the year”, he said, “It’s still a dynamic market and we believe H2 will be at 2-2.5 million sq.m, as Q4 is usually the most active quarter of the year.”

Demand has been driven by tenants seeking to optimize their supply chains in the current economic environment. “After years of double-digit rental growth, up 30%, rents are now stabilising”, Bertens said.

The vacancy rate has climbed from 1% to to 4,4%, but there are huge variations as there is no space available in key logistics hotspots, while secondary and tertiary locations are more vulnerable. Demand is increasingly concentrated on strong, well-connected locations and on modern, grade A, ESG-compliant stock.

Logistics investment volumes were €591 million in H1, down 44% compared to the same period last year as economic volatility and uncertainty dominated. But as the occupational markets stabilise, more deal activity is also expected later this year.

“Investment momentum should also gain traction in the later part of H2 as deal pipelines continue to build up and a growing number of larger assets and portfolios are returning to the market,” Bertens said. “There is sufficient dry powder, and the fundamentals of the Dutch market remain solid.”

“20-25% of total investments in commercial real estate are in logistics”, Bertens said. “The sector has replaced offices which used to be dominant.”