Logistics Census ’25: investors positive, occupiers cautious

Investors and developers are more confident while occupiers remain cautious, according to the findings of the 2025 European Logistics Real Estate Census, jointly produced by Savills, Brookfield Properties and Analytiqa, which has just been published and was presented in London at an event organised with Real Asset Media.

“Investors are positive, and occupiers are feeling less confident”, said Kevin Mofid, head of EMEA logistics research, Savills. “Occupier sentiment is improving, but that has not translated into higher take-up yet. It is a mixed picture, which is not surprising given the economic slowdown, political upheaval and astonishing level of disruption we have seen.”

The Logistics Census, which is in its fifth edition, this year has had 715 respondents, a record number, among investors, developers and occupiers across Europe.

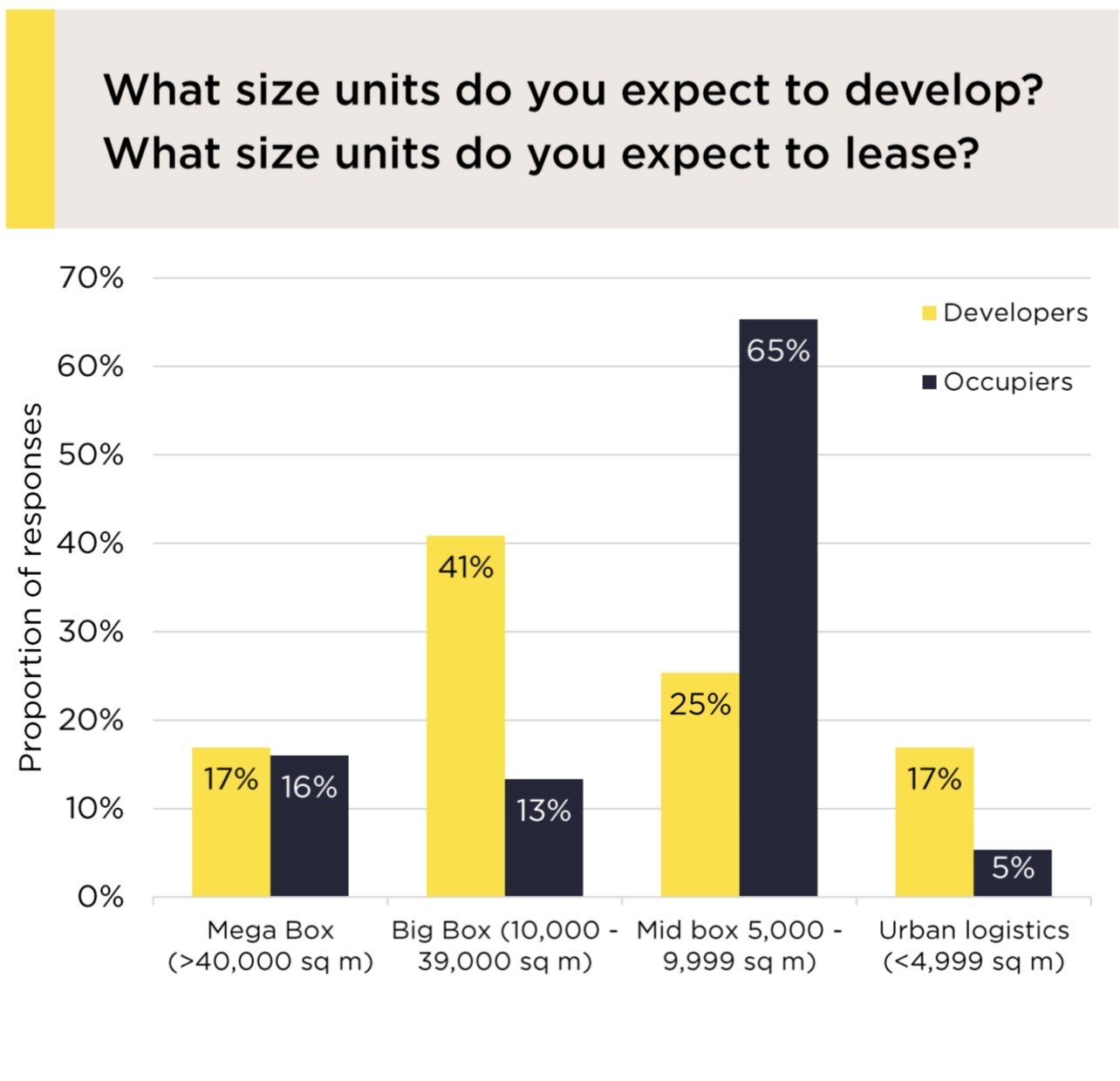

The survey shows that developers are stepping up activity, with 36% planning to speculatively build more space, a 12-point increase from last year.

Investment volumes in H1 are €18 billion, an 8% decline from last year. However, the survey shows that investors are also stepping up activity in anticipation of a rebound and sentiment continues to improve, with 46% believing market conditions are more favourable than a year ago and 56% expecting investment volumes to improve in the next 12 months.

Occupiers, by contrast, remain measured in their growth strategies, which have been impacted by weak economic growth and heightened global uncertainty: 57% have scaled back expansion plans, while 41% expect their warehouse space requirements to grow in the coming year. Only 4% have put their plans on hold indefinitely.

Within the occupier cohort, 3PLs are the most cautious as they fear a delayed exposure to macroeconomic turmoil. “Given 3PL’s business model relies on contracts from other companies, this may reflect an expectation that the effect of recent shocks are yet to be passed onto their businesses”, explained Mofid.

In general, “expansion plans are in the 1-3 year horizon rather than a few months, so deals take longer to get over the line”, he said.

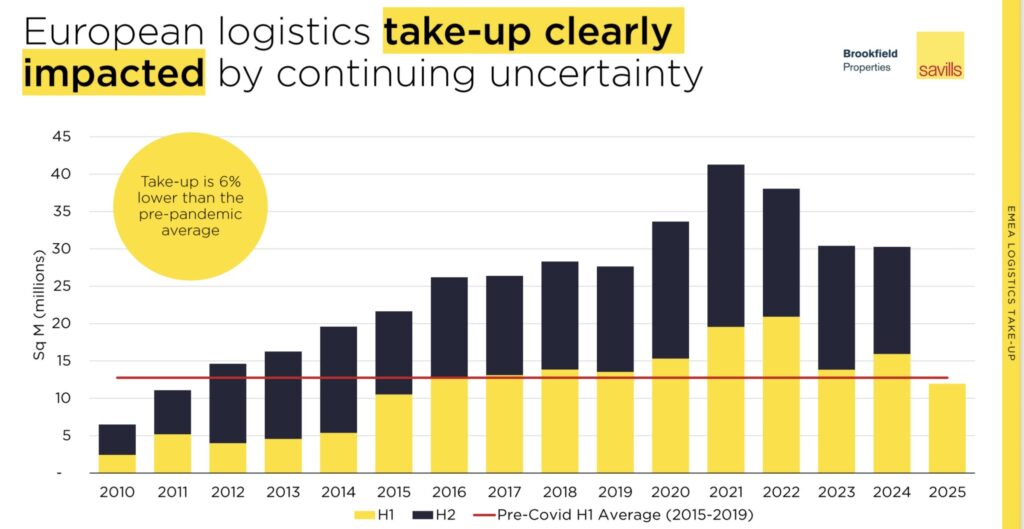

This is reflected in the data: take-up in H1 was 11.9 million sq m, 6% lower than the pre-Covid average. “It has been a slow start to 2025 after a strong Q4 2024”, said Mofid. “All eyes will be on Q3 numbers when they come out to give an indication of where things are going.”

The vacancy rate has crept up to 6.73% from a record low of 3.2%. The vacancy rate has actually increased in the last two quarters, mainly due to increased levels of supply in CEE markets. “But there is a huge range when looking at submarkets, from vacancy rates of 14% to close to 2%, so it is important to look at the data carefully when making decisions”, pointed out Mofid.

Western Europe continues to drive growth, with occupiers planning to focus their expansion in continental Europe. Companies with an established presence are targeting the big, mature markets like Germany, France, the Netherlands and Italy, while outliers like Portugal and the Czech Republic are benefitting from the nearshoring phenomenon.