Garbe Pyramid: defence sector and e-commerce strong demand drivers for logistics

Two trends are putting wind in the sails of the logistics sector, delegates heard at the ‘Garbe Pyramid H1 2025: European Logistics Real Estate Markets between awakening and stagnation’ presentation, organised by Garbe and Real Asset Media, which took place online this week.

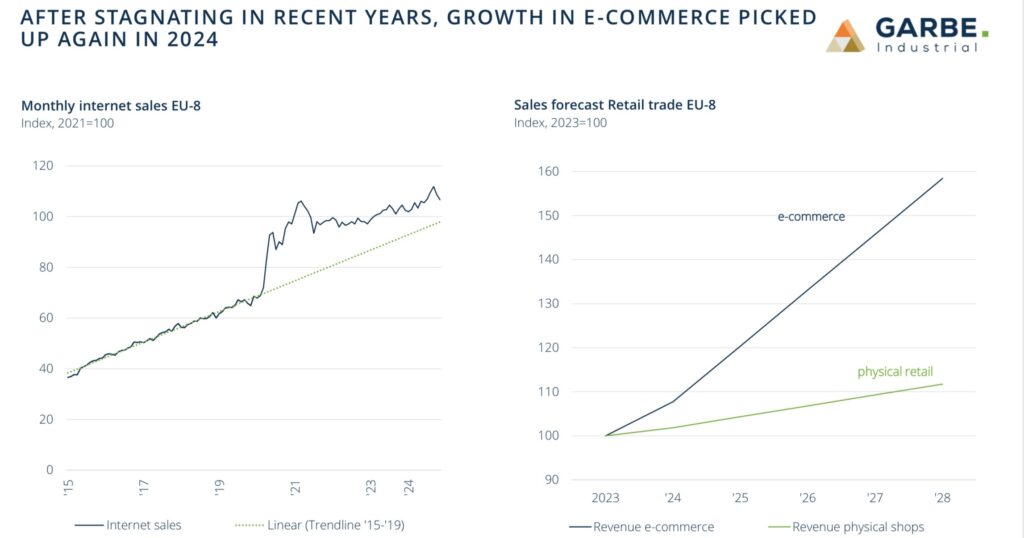

“The defence industry is growing and will be a significant future demand driver for logistics,” said Tobias Kassner, member of the Executive Board & Head of Research & ESG, Garbe. “And after stagnating in recent years, e-commerce has picked up again and is set to overtake physical retail.”

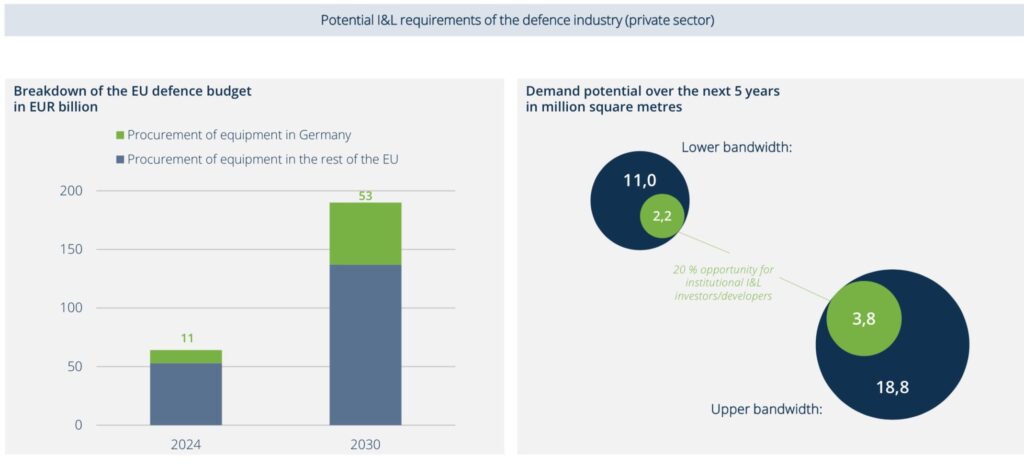

The demand potential of industrial & logistics space for the defence sector in the next five years is expected to be between 11 million sq m at the low end of the scale and a high estimate 18.8 million sq m, as all countries in the EU increase their budgets to strengthen their capabilities and self-sufficiency in the face of growing Russian aggression. For Germany alone the estimate is between 2.2 and 3.8 million sq m.

“The issue with the defence industry is that companies follow different patterns from traditional logistics, so the locations and spaces they need may not be the same”, said Kassner. “Most of the space needed will be custom built and very specialised. It makes it all the more important to have a data-driven approach.”

The return of online shopping is also a strong demand driver for European logistics, and the forecast is that it will continue growing at well above the rate of of growth of physical retail in the next few years.

“We are seeing strong interest from new market participants from China and elsewhere who don’t have a presence in Europe”, said Kassner. “The new players they have been putting real pressure on established players by offering low prices.”

Competition is changing the market, but rival companies tend to have different targets when it comes to logistics space.

“There is increased demand for smaller units and urban fulfilment centres from e-commerce players with an established network”, said Kassner. “But the new entrants tend to start with big boxes near where consumers are located.”

Cities and densely populated areas are always in demand. Garbe research shows that regional differentiation is intensifying, quality of location is becoming more important and the market is becoming more polarised.

Sentiment is improving and returns are stable despite difficult conditions. Prime yields are down in 36 of 121 markets examined, a signal that the cycle of decompression has come to a sustainable end.

Garbe predicts that yield compression will continue: over the next 5 years, a decline of 40 bp on average is expected, which means that the logistics market continues to offer investors attractive investment opportunities, but they will need to work on the property.

“Despite slowing momentum, the market still presents opportunities for investors, especially so in regions with convenient transportation access, specialized users, and high quality of location”, said Kassner. “Europe is seen as stable and remains attractive to investors, which is why we see capital inflows from all over the world.”