Garbe: five more years of rental growth for European logistics

Logistics rents will continue growing over the next five years and outpace inflation, giving an added incentive to invest in the sector, delegates heard at Real Asset Media’s European Logistics Real Estate Markets: is now the right time to invest? briefing, organised in collaboration with Garbe, which took place online yesterday.

The 2024 mid-year update of the Garbe Pyramid, the only pan-European market overview focusing on key indicators of the investment and rental market with the latest data and forecasts for the most important logistics real estate submarkets in Europe, was presented at the briefing yesterday.

For the first time, a forecast for the next five years was added to the Pyramid Map, developed together with Oxford Economics and integrating comprehensive macroeconomic and market-specific factors.

“A valid assessment of the status quo is crucial for a correct diagnosis of market opportunities and risks,” said Tobias Kassner, head of research, member of the executive board, Garbe Industrial Real Estate. “But only a well-informed forecast enables investors to have a targeted market strategy and pinpoint opportunities”.

In H1 this year rental growth has lost momentum, recording a 1.4% increase as demand slowed, but this represents a low point. The forecast’s key finding was that if the economy regains its momentum and inflation and interest rates continue to decline, as expected, prime rents will again start growing significantly over the next five years.

In the top 30 European top markets examined, the growth rate will average 3.1% a year, outpacing Eurozone inflation. London will see the biggest increase (+3.9%), closely followed by Munich (+3.8%) and Berlin, Hamburg and Manchester (all +3.5%).

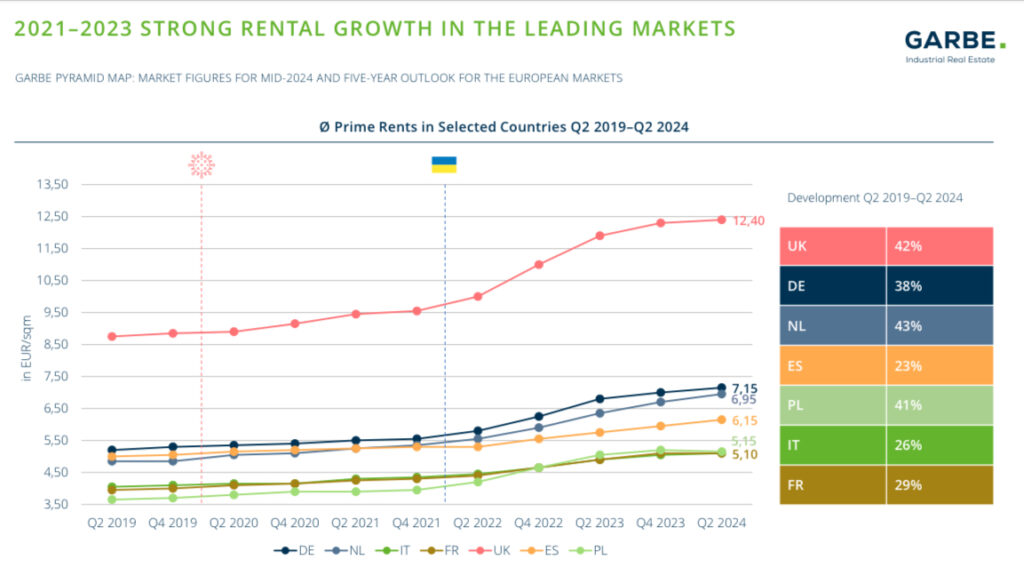

It is a picture in line with the trajectory of the last five years: between Q2 2019 and Q2 2024 rents increased by 43% in the Netherlands, 42% in the UK and 38% in Germany.

“High demand and low vacancy rates led to record increases in rents,” said Kassner. “In the future we’ll see more stability.” Rental increases will be more gradual but will continue.

“Construction costs, land costs and financing costs have gone up, so we still need to have higher rents,” he said. “The impact on occupiers is limited, because rent is usually 5-8% of total costs, not comparable to transport costs which are much higher.”

Higher rents also help to finance the ongoing and costly transition to ESG-compliant assets, adding PV panels and heat pumps to make them energy-efficient, resilient and future-proof.

H1 data show an improvement after the downturn of 2023, when transaction fell by 50% and take-up also declined markedly. “Interest rate rises started in 2022 but didn’t have an impact on the market until last year,” said Kassner. “Now take-up is close to the 10-year average and logistics is still one of the most sought-after asset classes in Europe, largely thanks to its excellent risk/return performance.”

So far in 2024 logistics has claimed a 21% share of the overall investment market, just behind offices (24%) and residential (23%), showing that the sector is standing its ground despite the headwinds. Capital is expected to continue flowing into industrial and logistics.

“There has been much repricing in the market, so now you can get good assets in good locations at good prices,” said Kassner. “It’s the right time to invest in European logistics.”